Calculate my salary after tax

For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount. The size of your paycheck will depend of course on your salary or wages.

Excel Formula Income Tax Bracket Calculation Exceljet

That means that your net pay will be 43041 per year or 3587 per month.

. For instance an increase of. How Your Massachusetts Paycheck Works. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Youll then get a. Earnings from various modes in a financial year subject to income tax for the whole year is treated as income after tax. Either way we hope to aid you in your investigations with this easy to use tax-on-salary calculator.

You paid 1481 in tax. If you make 55000 a year living in the region of New York USA you will be taxed 11959. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

How do u calculate tax. Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Total annual income Tax liability. If you are earning a bonus payment one month. Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

For the next 5. Your average tax rate is 270 and your marginal tax rate is 353. Its so easy to.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Your average tax rate is 270 and your marginal tax rate is 353. This marginal tax rate means that your immediate additional income will be taxed at this rate.

It can be any hourly weekly or. There are various components of after-tax income. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Related Income Tax Calculator Budget Calculator. 25 lakhs you pay 5 ie.

After Sales Tax Calculator. Your average tax rate is 217 and your marginal tax rate is 360. Calculate how tax changes will affect your pocket.

Gross pre-tax Income Per. But it will also depend on your marital status your pay frequency and. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

25 lakh of your taxable income you pay zero tax. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your. 5Take home over 500mth.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. This marginal tax rate means that your. FAQ Blog Calculators Students Logbook.

The calculator will work out how much tax youll owe based on your salary. How to use the Take-Home Calculator. Income qnumber required This is required for the link to work.

Your average tax rate is. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. STEP 4 Calculate Your Taxes For the first Rs.

Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS. For instance an increase of. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate.

Youll then see an estimate. Find out how much your salary is after tax. Build Your Future With A Firm That Has 85 Years Of Investing Experience.

Yes you can use specially formatted urls to automatically apply variables and auto-calculate. For the next Rs. For example if an employee earns 1500 per week the individuals.

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Sage Income Tax Calculator. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

Simply enter your gross salary choose if youre being paid yearly monthly or weekly and let our site do the rest. This marginal tax rate means that your immediate additional income will be taxed at this rate. That means that your net pay will be 43041 per year or 3587 per month.

Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Your average tax rate is. If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month.

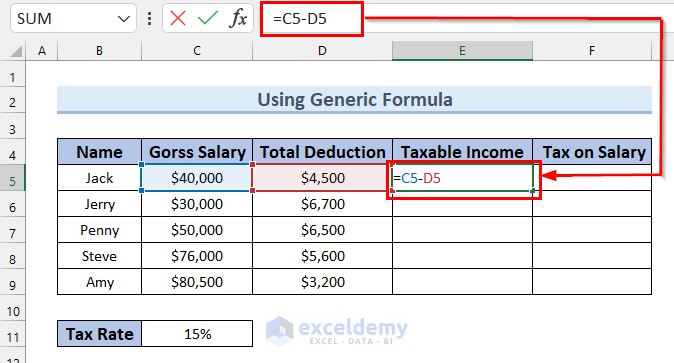

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Example In Excel

How To Calculate Income Tax On Salary With Example

How To Calculate Net Pay Step By Step Example

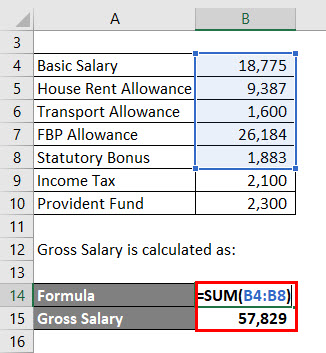

Salary Formula Calculate Salary Calculator Excel Template

80 000 After Tax Us Breakdown September 2022 Incomeaftertax Com

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube